Why Bookkeeping is Key for Startups

Starting a business can be super exciting but dealing with finances can feel pretty overwhelming. A lot of new entrepreneurs get so caught up in building their products and services that they forget about one really important thing: keeping their books in order. Good bookkeeping is essential for a bunch of reasons:

- Clear Financial Picture: It helps you see exactly how your business is doing financially so you know where you stand.

- Smart Planning: With organized financial records, you can make better budgets and plan for future expenses and growth.

- Investor Trust: Investors are more likely to back a startup that shows it knows how to manage its finances properly.

Take the example of a small tech startup that just launched an app. They were pumped about the app’s positive reviews but didn’t keep track of how much they spent on development and marketing. When it was time to seek more funding, they couldn’t show solid financial records to potential investors, which led to missed chances for cash flow.

What Bookkeeping Services Involve

If you want your startup to have solid financial footing, it helps to know what bookkeeping services are out there. These can vary quite a bit but usually include:

- Recording Transactions: Keeping a tidy log of sales and expenses.

- Reconciliation: Making sure your internal records match what your bank and other sources say.

- Financial Reporting: Putting together important documents like income statements to gauge how well you’re doing.

- Payroll Management: Handling employee salaries and tax responsibilities.

Many startups might choose between:

- In-house Bookkeepers: Hiring someone to handle finances every day.

- Freelance Bookkeepers: Bringing in freelancers for flexible and often cheaper help.

- Accounting Firms: Partnering with firms that provide full financial management services.

These services help startups follow regulations and keep accurate records, letting founders focus on what they do best—innovating and growing.

Benefits of Having a Pro Manage Your Books

One of the biggest perks of having a professional handle your bookkeeping is keeping accurate financial records. With a skilled bookkeeper, you can dodge common pitfalls like:

- Tracking Income and Expenses: You’ll know where your money’s coming from and where it’s going.

- Spotting Trends: You can see spending habits and revenue patterns.

- Keeping Transactions Straight: Avoiding mistakes that lead to financial headaches.

For instance, a startup that sells handmade goods found itself overwhelmed with orders. After outsourcing their bookkeeping, they discovered they were underpricing their products, which hurt their profits. Getting professional help opened their eyes to this issue and helped them adjust pricing.

Navigating Tax Time

Tax season can be a nightmare for any business, particularly for startups without a lot of financial know-how. Professional bookkeeping helps remove the stress during tax time by ensuring:

- Timely Preparation: Accurate records mean you’ll get your tax forms ready on time.

- Maximized Deductions: A good bookkeeper knows the tax code and can help you snag deductions you might miss.

- Audit Readiness: Well-kept records mean you’re covered if you get audited.

Consider a food delivery startup that was confused by sales tax rules. Thanks to their bookkeeping, they managed to navigate the tricky tax laws without getting slapped with fines, all while making the most of their deductions.

Managing Cash Flow

Cash flow is everything for a startup. Good bookkeeping gives you the insights needed to manage it better by:

- Forecasting: Helping you predict income changes and plan for costs.

- Spotting Shortfalls: Letting you know about potential cash flow issues before they blow up.

By keeping an eye on their cash flow, startups can tweak their plans as needed, ensuring they stay afloat and ready to jump on growth chances.

Making Smart Decisions

When you have accurate records and solid cash management, you can make better decisions. Access to financial reports helps you:

- Spot Opportunities: Find profitable product lines or market trends.

- Evaluate Costs: Understand your return on investment in various areas.

A tech startup used its financial data to shift its business model after seeing customer feedback. This pivot led to a successful new service launch. So, good bookkeeping is really not just a chore; it’s a strategic tool for startups.

Common Bookkeeping Hurdles for Startups

Not Having Enough Time and Resources

Launching a startup can be chaotic, and one of the big challenges is finding time and resources for bookkeeping. In the rush of getting everything off the ground, founders often let financial management slide. This causes issues like:

- Missed Records: Small expenses get forgotten, which means your financial picture remains incomplete.

- Inefficient Procedures: When you’re rushed, errors happen more often.

A graphic design studio once started taking payments but didn’t track project expenses regularly. They were shocked when they found out how low their profits actually were—a big wake-up call for them to revamp their bookkeeping.

Dealing with Financial Regulations

Figuring out financial regulations can feel complicated, especially for startups. Regulations keep changing, and it’s easy to feel lost. Common issues include:

- Tax Requirements: Different places have their own tax laws, which can complicate things.

- Invoicing Rules: Following invoicing standards can add to your plate.

Think of a health-focused startup that had a tough time with billing regulations. They realized they needed some expert help to navigate those complexities, allowing them to focus on their core business instead of getting bogged down with legal mumbo jumbo.

Keeping Records Straight

Accurate record-keeping is essential, but many startups struggle here. Early mistakes can snowball into bigger problems. Common slip-ups include:

- Inconsistent Data Entry: If you don’t record transactions when they happen, it can create confusion.

- Messed Up Systems: Using different platforms for things like sales and expenses can lead to a scattered approach that makes tracking harder.

A small e-commerce store faced these issues when they used different methods to track various aspects of their business. This led to inaccurate reports and inventory mix-ups, which hurt their sales. Recognizing and addressing these challenges can help startups improve their financial practices and set them up for growth.

Picking the Right Bookkeeping Service

Once startups see how important professional bookkeeping is, the next step is figuring out which service is right for them. Here are some options:

- In-House Bookkeeping: Hiring staff to handle finances daily. This can be more costly but allows for better control.

- Freelance Bookkeepers: Bringing in freelancers for ongoing or project-based work can be flexible and less expensive.

- Accounting Firms: Partnering with established firms that provide comprehensive services.

- Online Bookkeeping Services: Using cloud-based platforms for remote access, often at a lower cost.

For a tech startup, an online service that syncs well with their software might be best, while retail startups may want in-house help due to higher transaction volumes.

Factors to Keep in Mind When Hiring a Bookkeeper

When it’s time to hire someone, keep these factors in mind:

- Experience and Qualifications: Check if they know your industry and have relevant certifications.

- Tech Skills: Make sure they are comfortable with common accounting software.

- Communication Skills: They should clearly explain financial concepts and give regular updates.

- Scalability: Look for someone who can grow with your business, providing extra support as needed.

One friend’s experience showed how valuable it was to hire a bookkeeper who knew the e-commerce world. This knowledge helped their business thrive.

Questions to Ask Potential Bookkeepers

Before you make a decision, ask potential bookkeepers these questions:

- Can you share references from similar businesses?

- How do you ensure my financial records are secure and confidential?

- What’s your fee structure?

- How often will you provide financial reports?

- What’s your process for handling discrepancies or mistakes?

Having this dialogue not only sets expectations but also builds trust. A startup owner I know learned the hard way that not asking about a bookkeeper’s availability led to frustrating delays in decisions and reports.

Bringing Bookkeeping into Other Business Areas

Tying it with Financial Planning

Blending bookkeeping with financial planning is critical for any startup’s success. When both functions are in sync, businesses can create a financial strategy that aligns with their goals.

- Aligning Budgets with Performance: Regularly checking your books helps you see how actual income and expenses stack up against the budget.

- Cash Flow Forecasting: Analyzing past data helps predict cash flow, getting you ready for seasonal shifts or unexpected costs.

A friend who opened a bakery learned that her original budget didn’t consider high holiday demand. By aligning bookkeeping with planning, she adjusted inventory and staffing, leading to better profits during busy seasons.

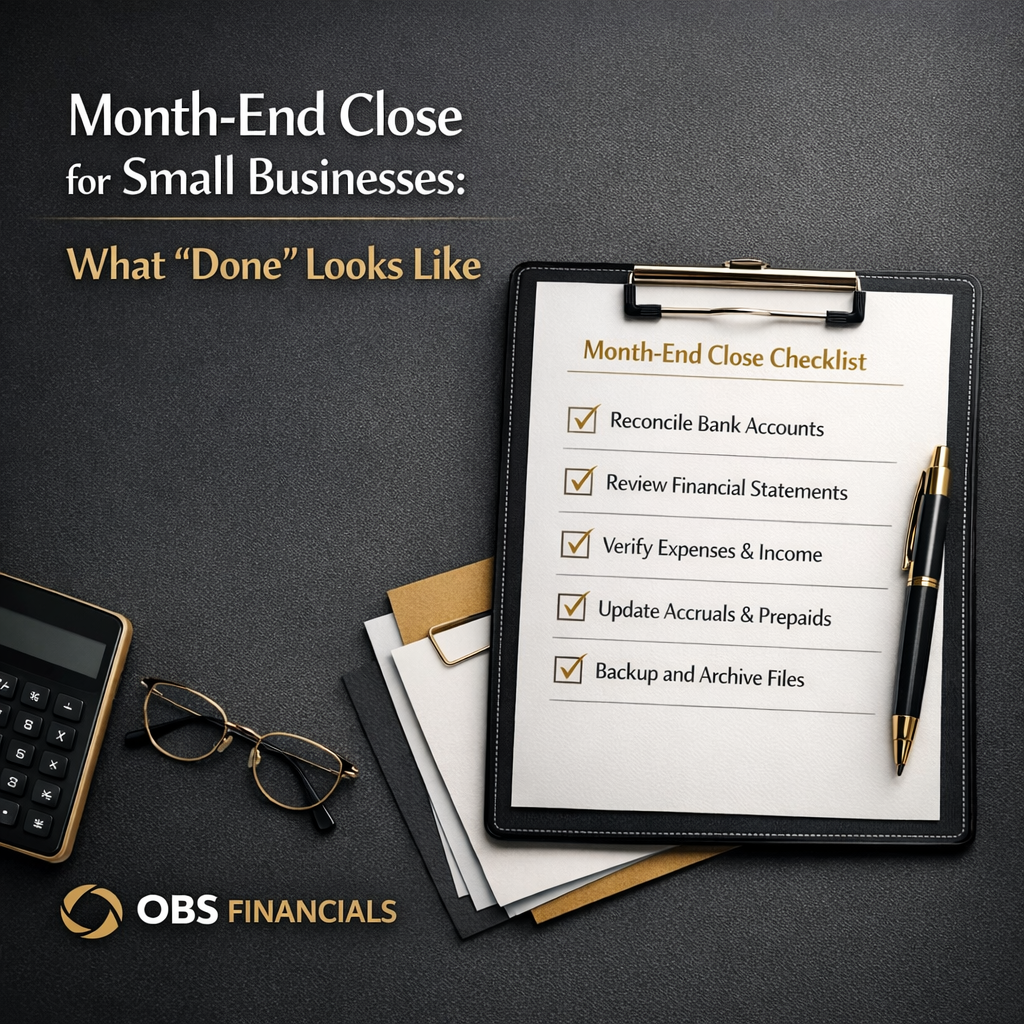

Importance of Regular Financial Reporting

Regular financial reports are key to integrating bookkeeping into business operations. With consistent updates, startups can make informed decisions based on their current financial position. Benefits include:

- Real-Time Insights: Monthly or quarterly reports give you a real-time look at performance.

- Accountability: Regular reports promote transparency, ensuring everyone’s on track towards financial goals.

A fitness startup started doing monthly reports and found out about lucrative classes that were being under-promoted. This led to strategies that dramatically increased attendance rates.

Leveraging Technology for Better Bookkeeping

In today’s digital world, using technology can really boost your bookkeeping and how it fits into your overall business. Check out these tech options:

- Cloud-Based Software: Platforms like QuickBooks and FreshBooks offer real-time access for better teamwork.

- Automation: Automating invoicing and payroll can cut down on mistakes and save time.

- Analytics Tools: Using analytics helps you gain insights that allow quick strategy shifts when needed.

A colleague running a SaaS startup switched to an integrated financial tool that made bookkeeping, budgeting, and reporting so much easier. This change improved accuracy and made team meetings way more effective, allowing for quick adjustments to their business model. By integrating bookkeeping with other functions, startups can have a complete view of their operations, helping them succeed in a competitive landscape.

Final Thoughts

Why Professional Bookkeeping Matters

To wrap up, professional bookkeeping isn’t just a minor task; it’s essential for running a successful business. Good bookkeeping offers numerous benefits, particularly for startups looking to gain a competitive edge. Here are the main takeaways:

- Financial Clarity: Well-kept financial records provide owners with a clear understanding of their business’s health, enabling better decisions.

- Easier Compliance: Professional help makes it much easier to navigate tax laws and regulations, reducing stress during tax season.

- Smart Cash Management: Regular bookkeeping reveals cash flow patterns, allowing for more informed financial planning.

- Enhanced Decision-Making: Solid financial reports enable businesses to adapt strategies based on accurate data, minimizing risks and maximizing opportunities.

Reliable bookkeeping can transform a business’s financial stability and management efficiency. It provides peace of mind, allowing business owners to focus on growth, creativity, and innovation.

Invest in Professional Services

If your startup is still handling bookkeeping in-house or lacks financial clarity, it’s time to consider hiring professionals. While it may feel like a big step early on, the rewards far outweigh the costs. Here’s why making the switch is a smart move:

- Expertise: Professional bookkeepers bring the expertise needed to avoid costly mistakes.

- Time Savings: Outsourcing your finances frees you to concentrate on product development and customer satisfaction.

- Scalability: As your business grows, bookkeeping services scale with you, ensuring seamless support.

Investing in proper bookkeeping is an investment in your startup’s future. You’re not just ensuring survival— you’re setting the foundation to thrive.

For expert bookkeeping services tailored to your needs, visit our bookkeeping services page and take the first step toward financial clarity and growth.